Following up from the previous article about Chase signup bonuses, this two bucket model is quite useful.

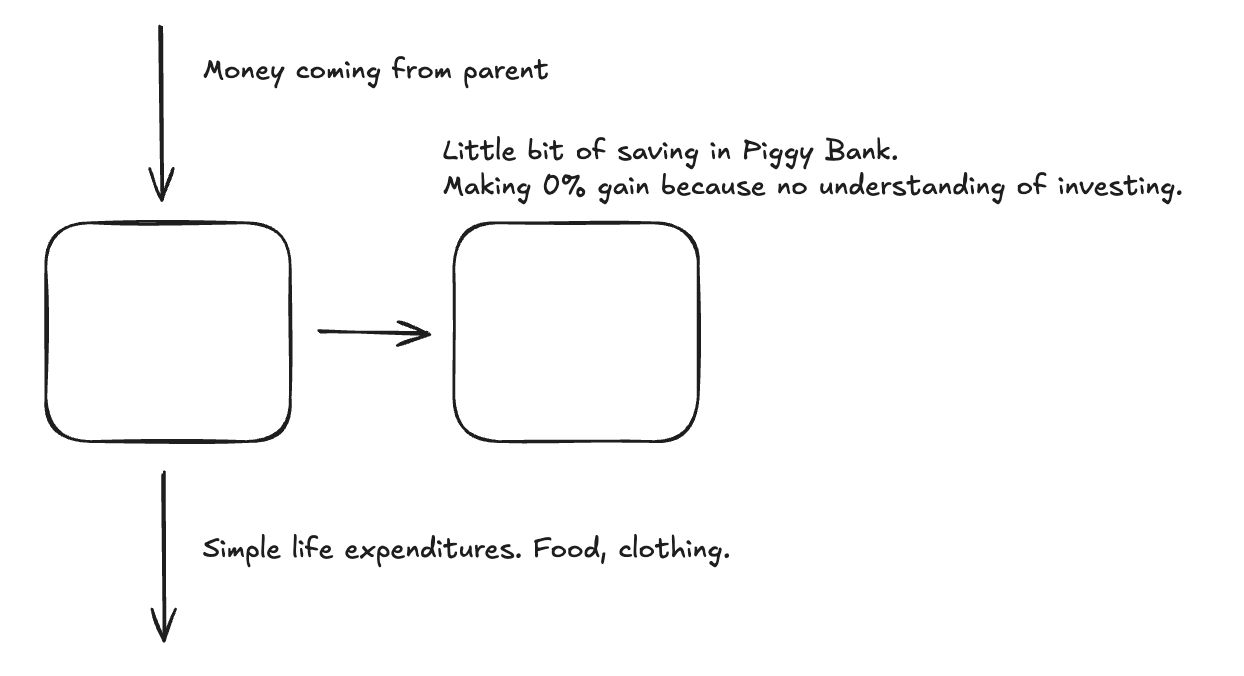

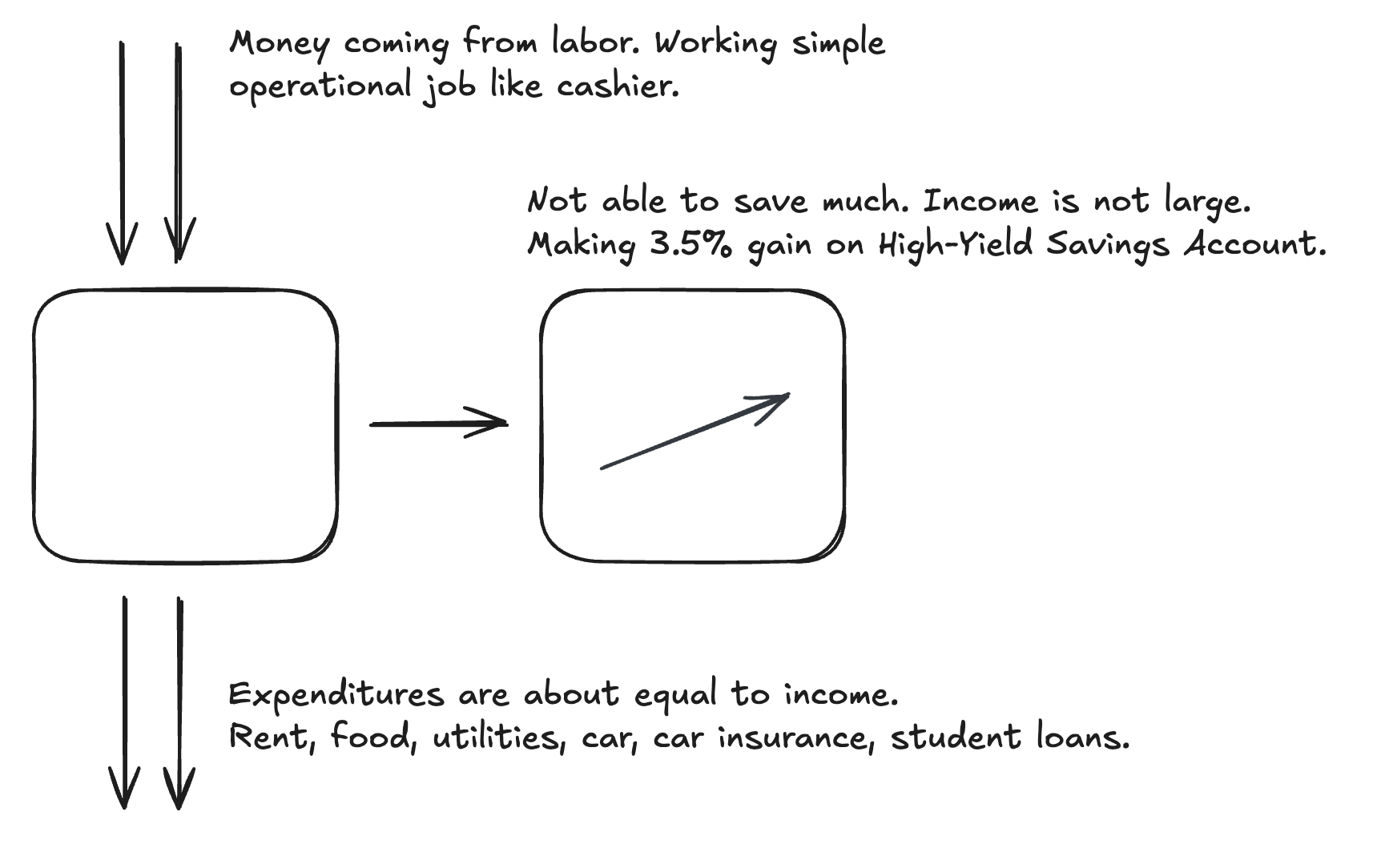

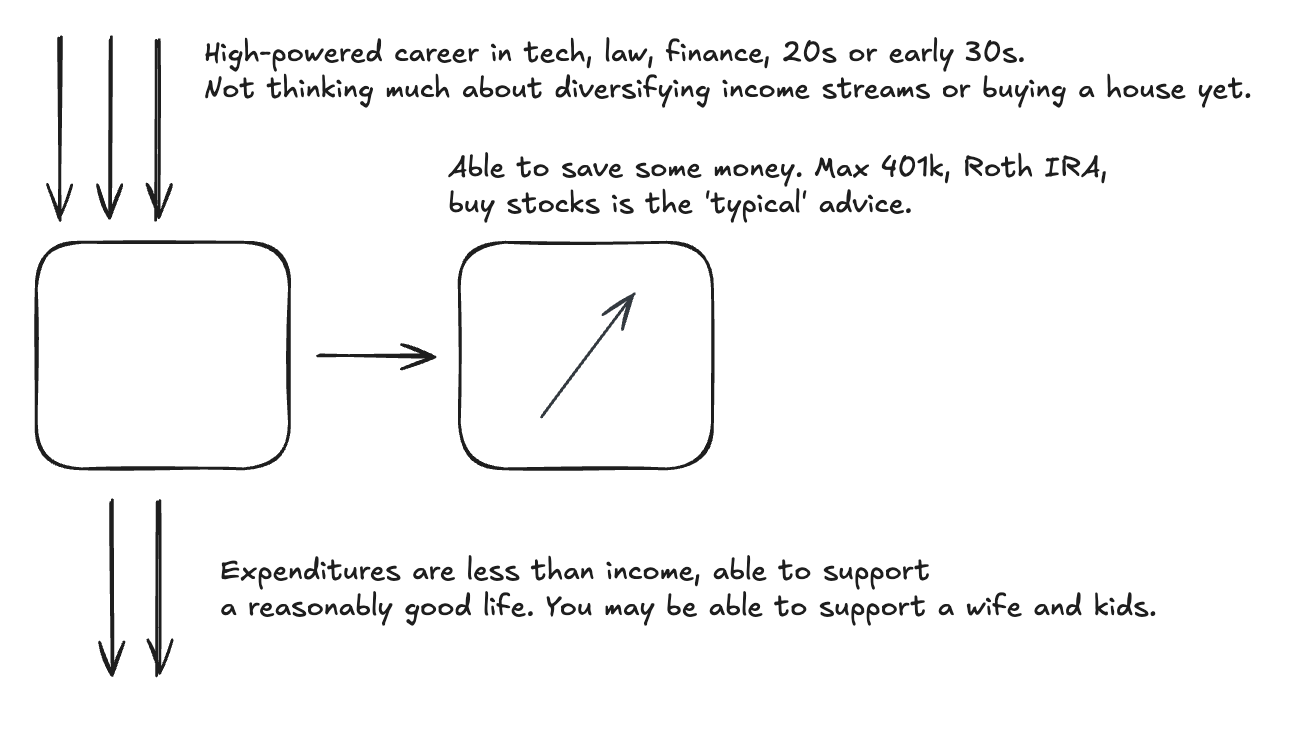

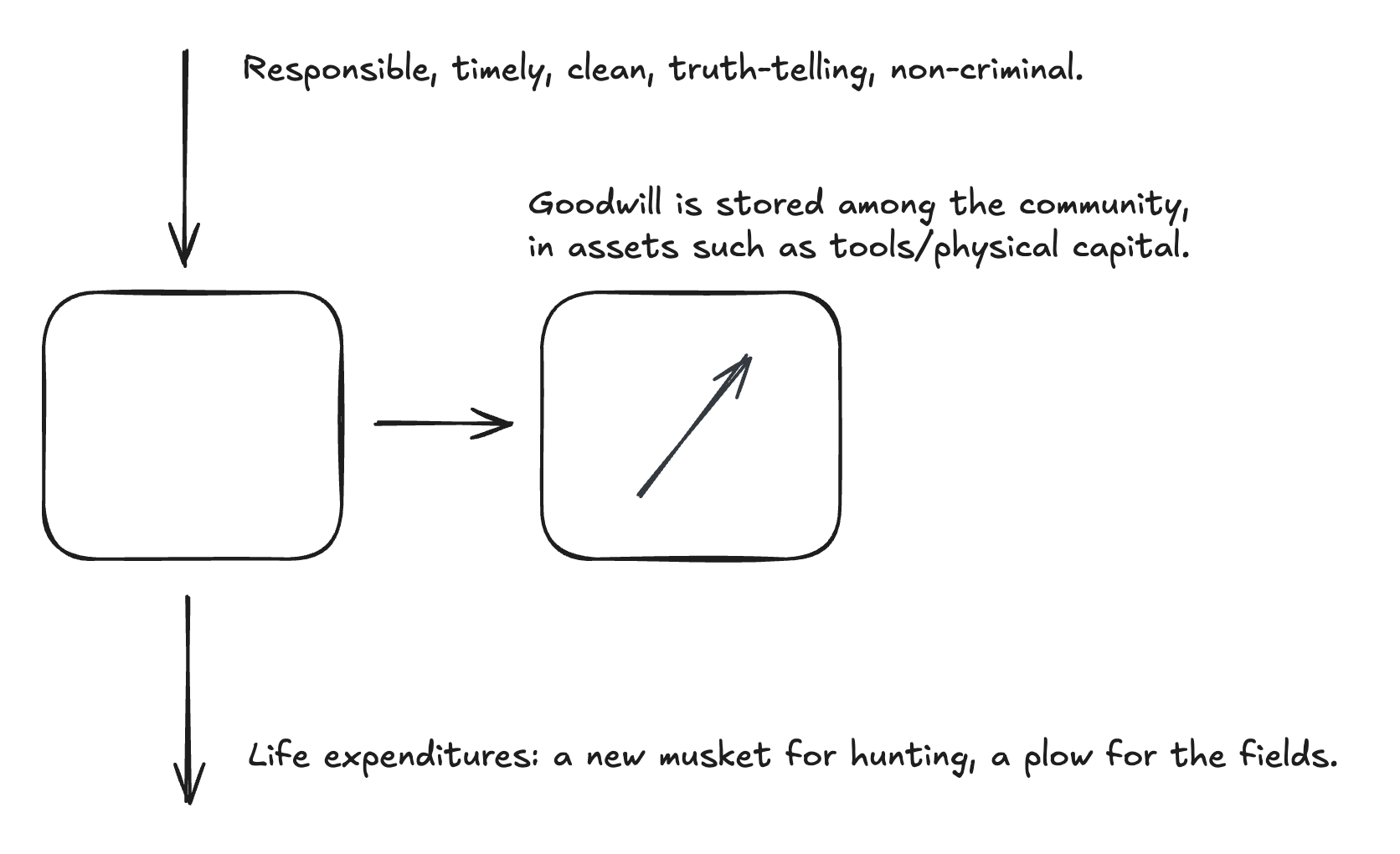

Let’s call the left tank the Consumption tank, used for routine expenditures, and the right tank the Storage/Accumulation tank, which is long-term capital accumulation. The longer in human timescales you think/risk-wise/demand, the larger the tanks will be and the further from subsistence you are.

For some reason this explanation is much easier to model mentally than some numbers/graphs saying “society is having 10% more in the underclass each year.”

Flow stages

Dependent

Your tank gets filled but there are no demands on you. Your tank is being filled by a parent for example.

Subsistence Independent

Your input and output roughly match. There is not much saving ability.

Strongly Independent

Your input wealth is much greater than your output.

Primeval Model

Long-term societies/thinking

Based on trust. Inputs are work, responsibility, consistency, truth. Storage fills as a person does more. In sickness or old age, things can be withdrawn from Consumption, which pulls from Storage. An unreliable person mooches around and doesn’t do anything, so they receive little benefit.

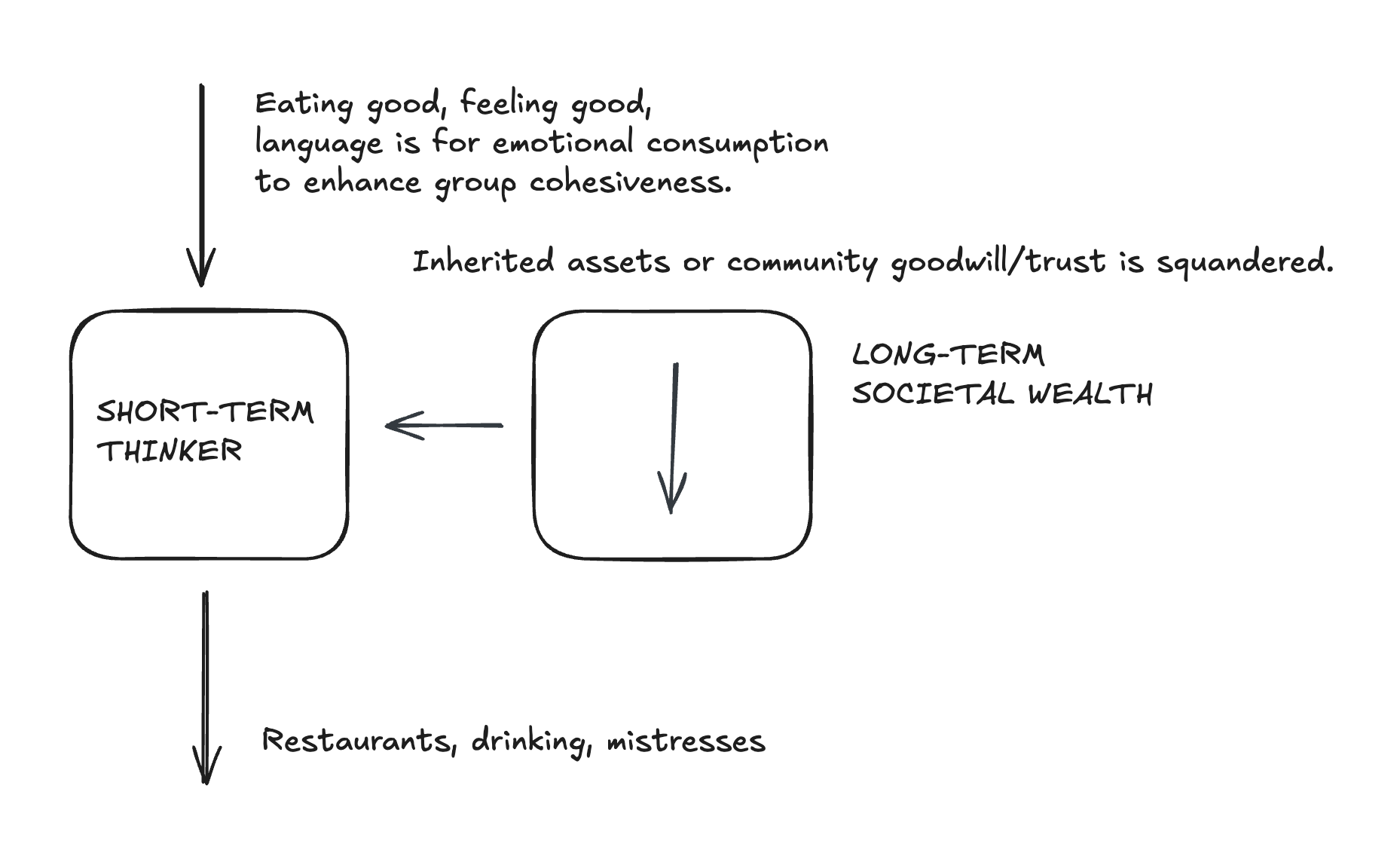

Short-term societies/thinking

The long-term storage tank barely exists. Short-term thinkers in a long-term community will destroy it. Community feeling is enhanced by short-term social-emotional behavior to exploit natural resources because these behaviors happen in relatively bountiful/warm environments. As long as someone can scrounge enough food together things are fine.

Economic Working Conditions

Working

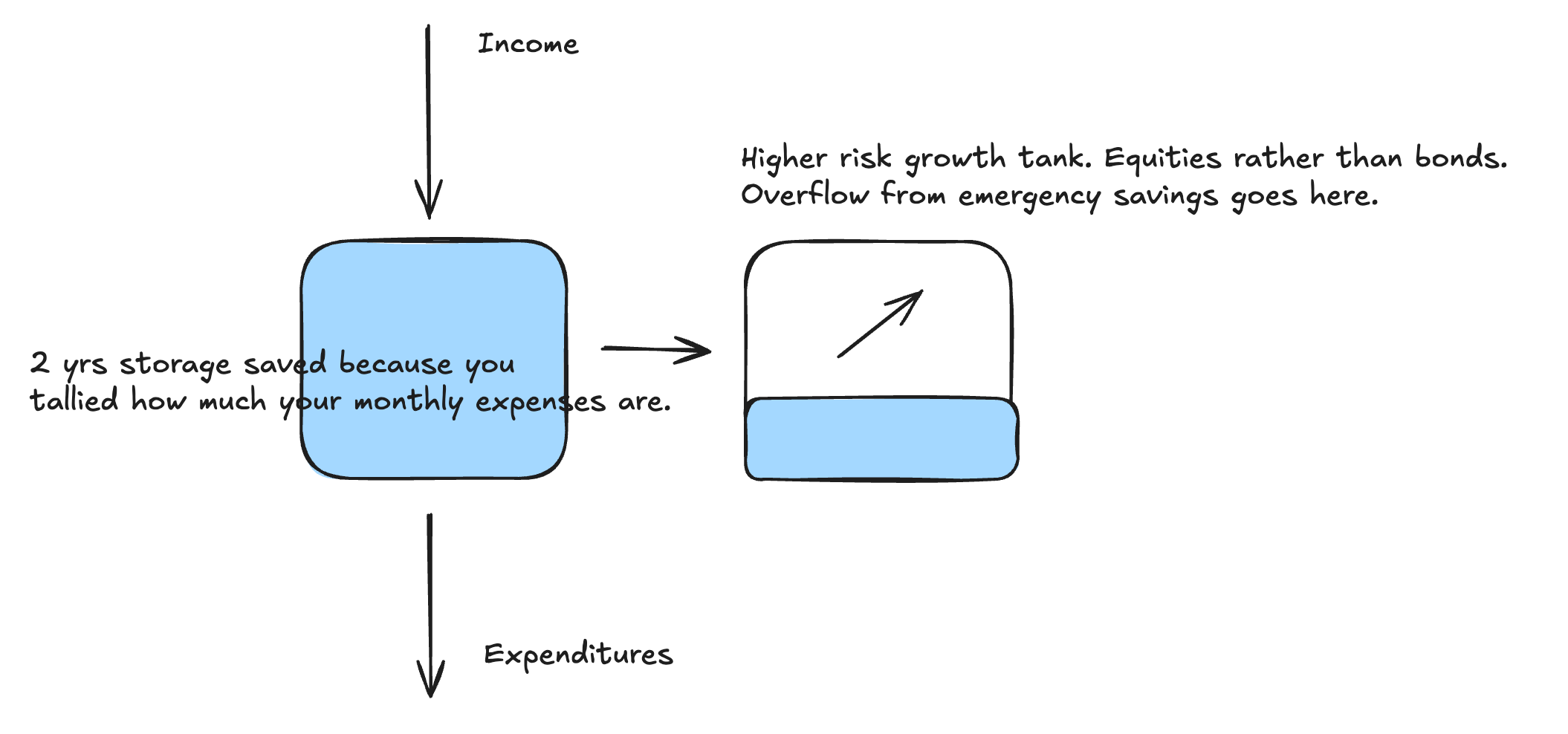

First you inflate your emergency savings/Consumption/daily expenditures tank. Then you inflate the Storage/Accumulation tank.

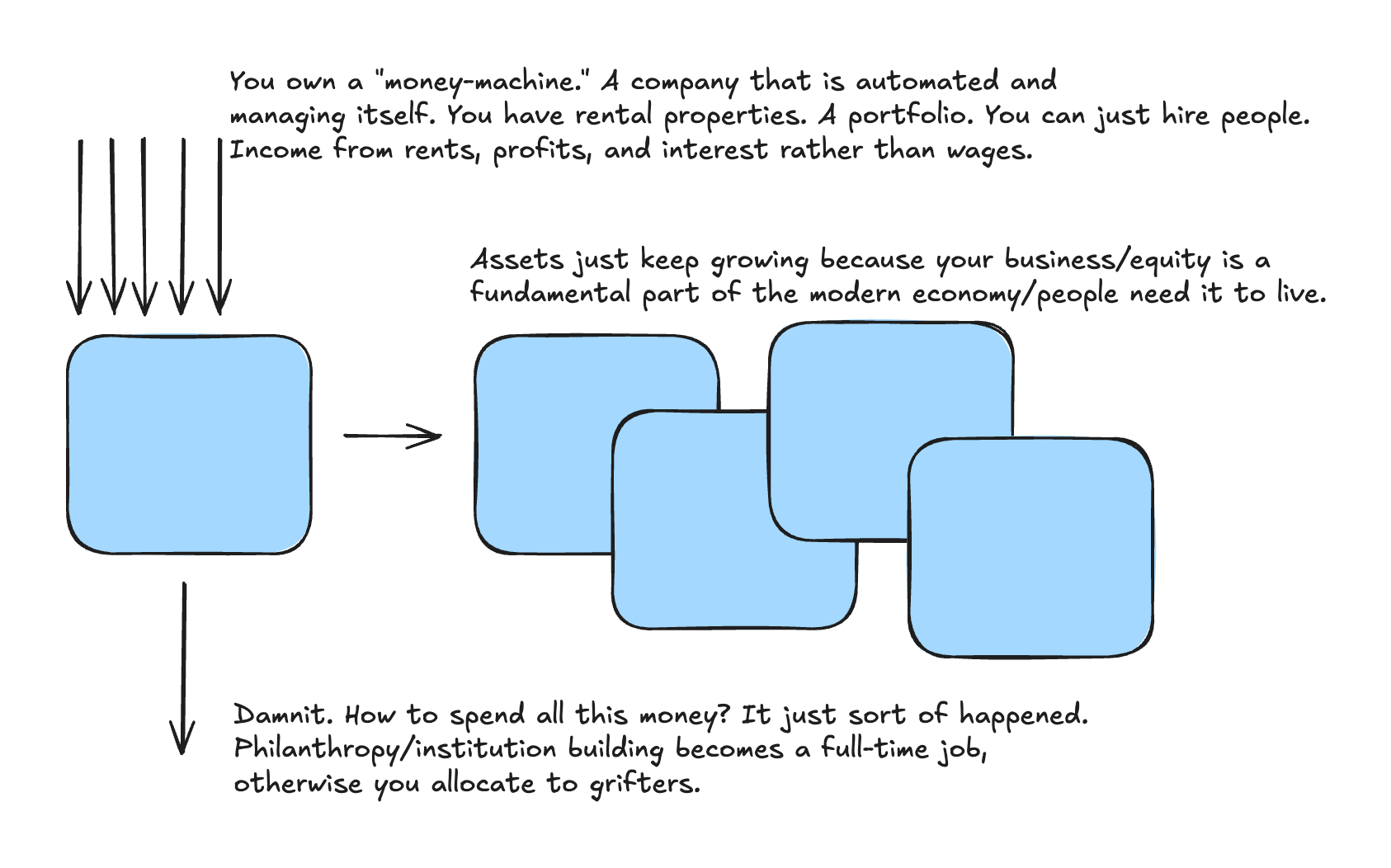

Early in life, your income is due to labor (spending time for money), but the goal is to turn it into Capital/Rents (business/intellectual labor/a sort of money machine that just works) so you can free up your time.

We introduce this new “blue” variable to account for time/money storage, as money is kind of like flow/water. The important part about enumerating your expenses are that you don’t look at your account and see “ONE BIG NUMBER!” That makes you feel that you can spend the entirety of it, or you have to suddenly sell stocks/real estate/other assets to fund sudden other expenditures, like an expensive mortgage after losing job. You start to think institutionally rather than spontaneously.

By clarifying what your wants and expenditures are, and knowing the amount of risk you can afford to take in-between jobs, you introduce a time-oriented certainty to your existence. I think two buckets is enough, I wouldn’t create multiple consumption ones for large purchases.

(if you have a family/trust fund, maybe 6 months is fine. If job market is bad, maybe 1.5 years. If your mortgage is high, also prolong the emergency savings tank.)

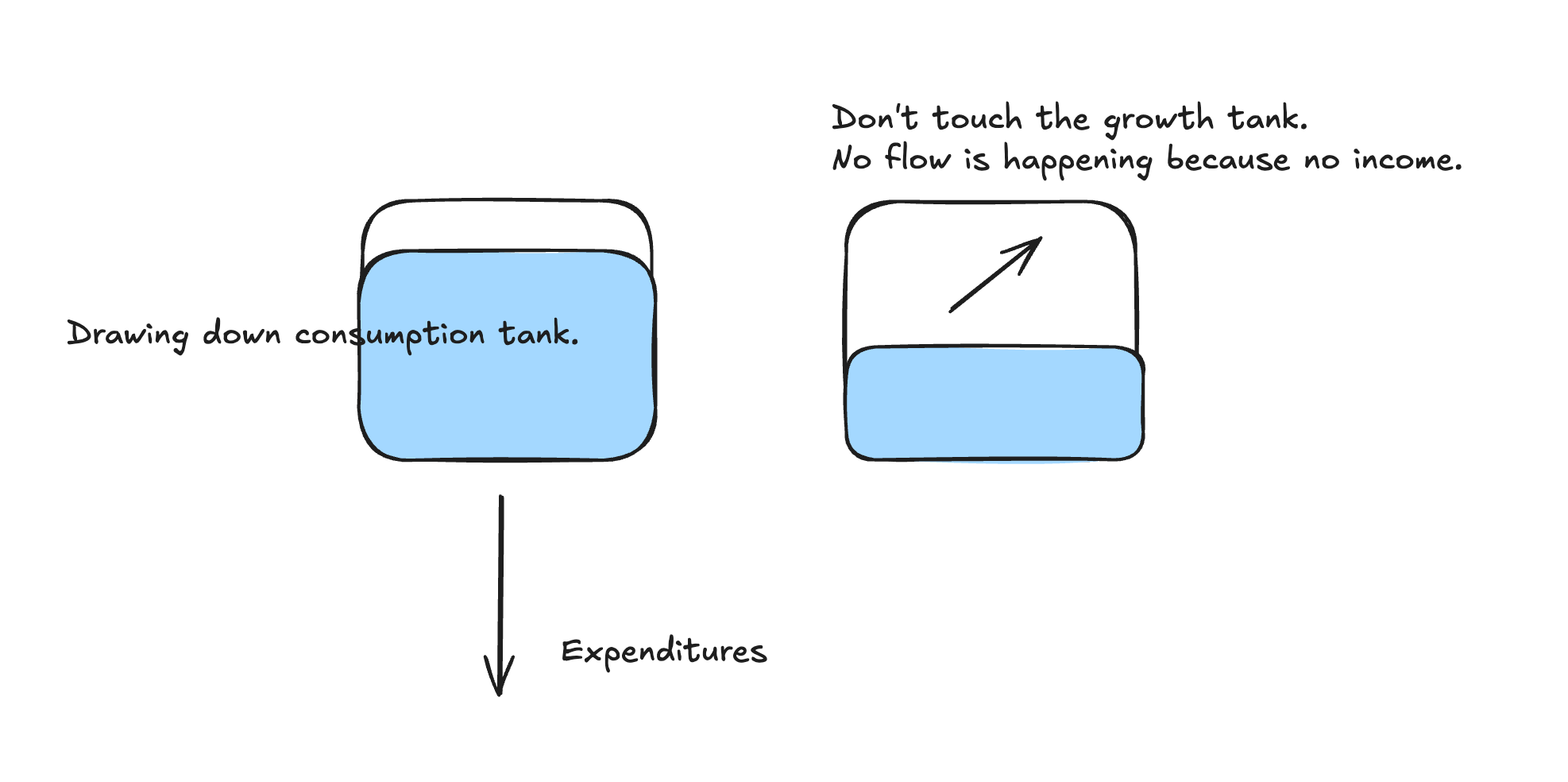

In-between jobs

You are drawing from your Consumption/daily expenditures tank of which your expenses are hopefully enumerated rather than the long-term Storage/Accumulation tank.

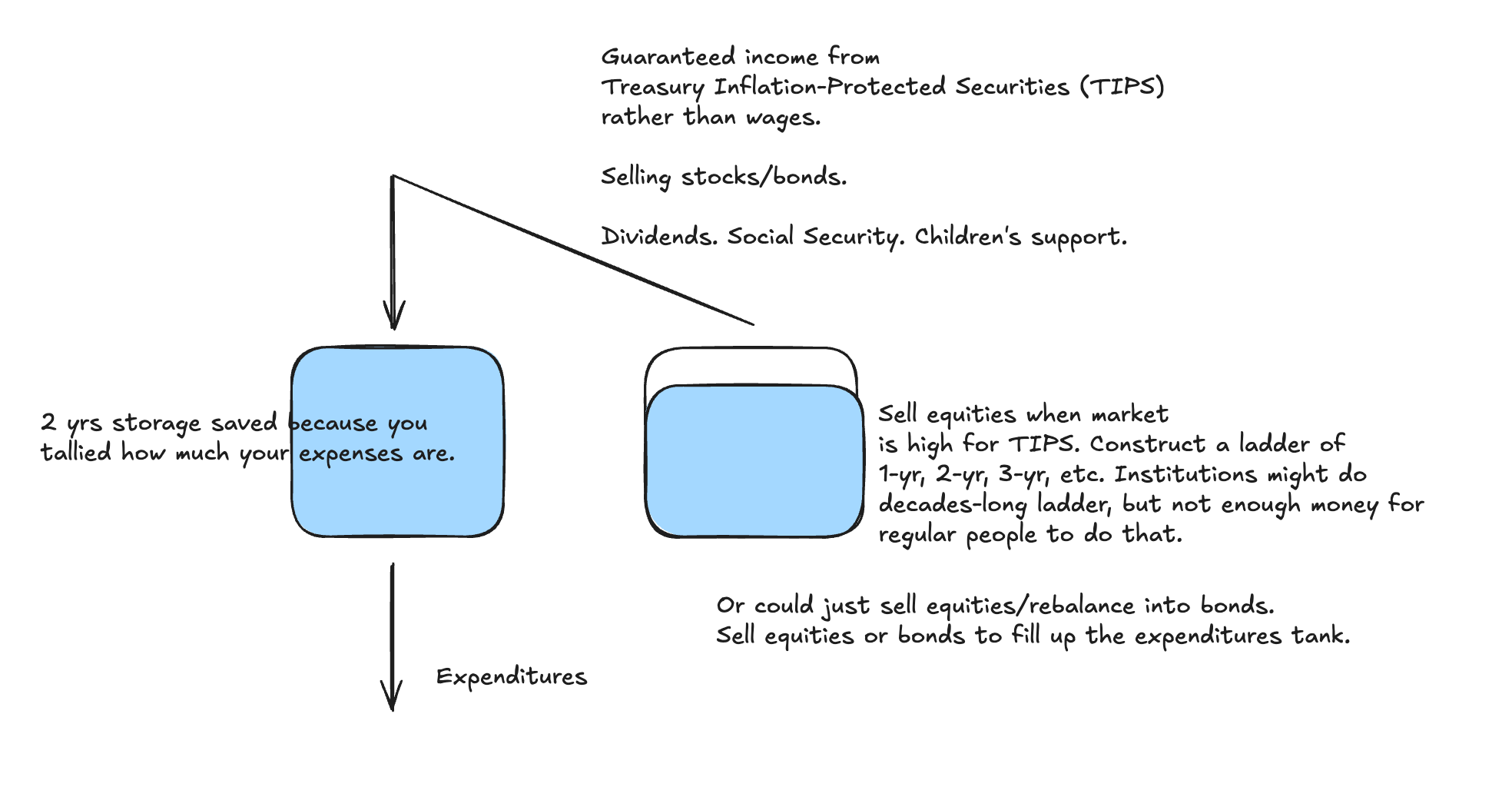

Retired and drawing down the Storage tank

I believe this is where the “TIPS” ladder comes in. It is safer than bonds and is guaranteed income.

Interest/Rents/Profits greatly exceed expenditures

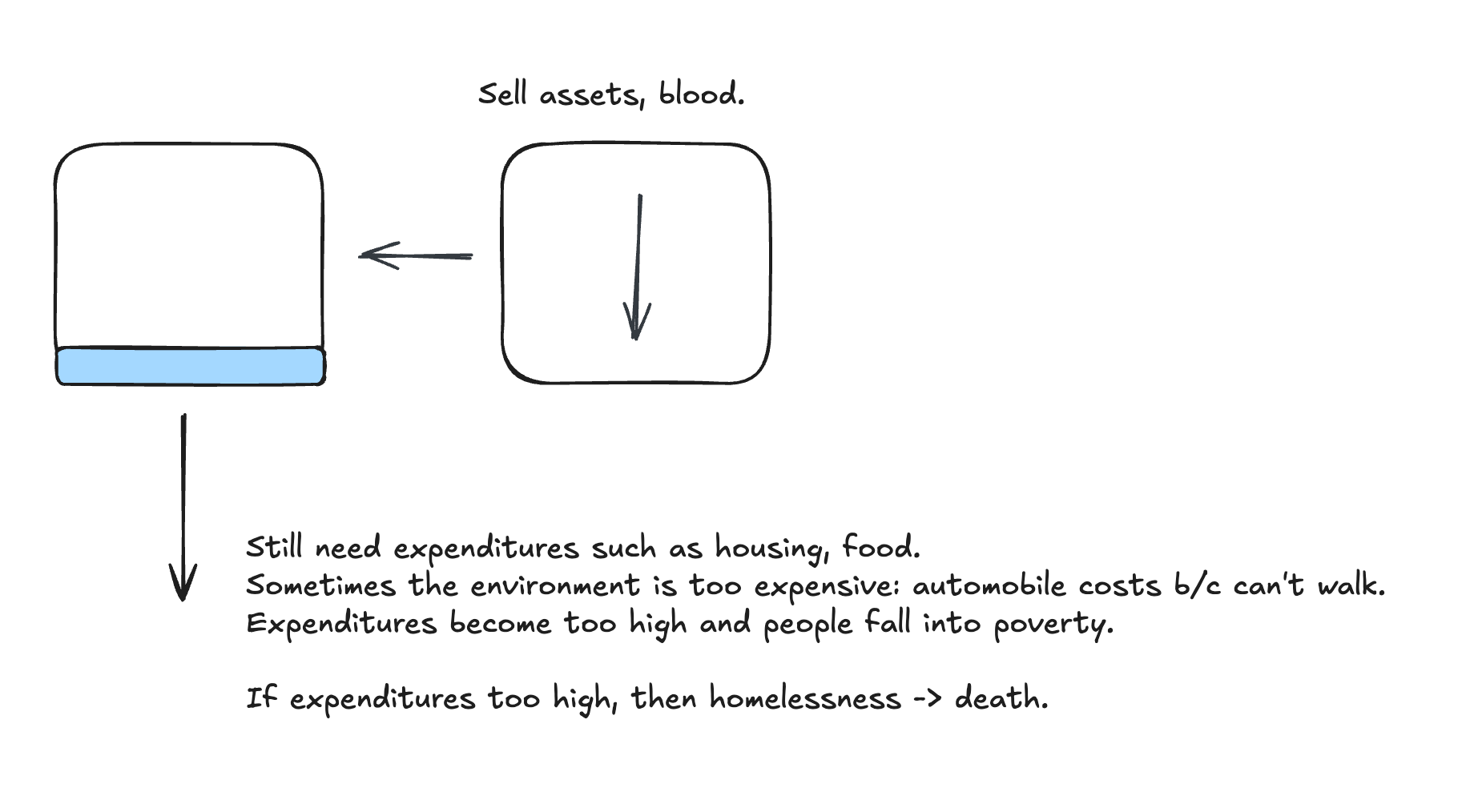

The edge of society

These people are homeless, they have little skills, assets, labor, or group feeling. As a society grows or shrinks, society can have more people on the edges. That more people in the US have to sell blood for money means American ‘society’ as a whole has been shrinking. The edge and the deprivation is getting bigger, so to speak.

Drug addicts for example are drawing down on their assets permanently: they trash their family relations, then pawn their assets, then sell blood, then they have nothing and death awaits them.

If States permanently infuse income into these sorts of people, this is a self-destroying loop where such behaviors propagated to children will be unable to produce value and construct things, thus destroying the original source of charity.

Group Feeling

Family Model

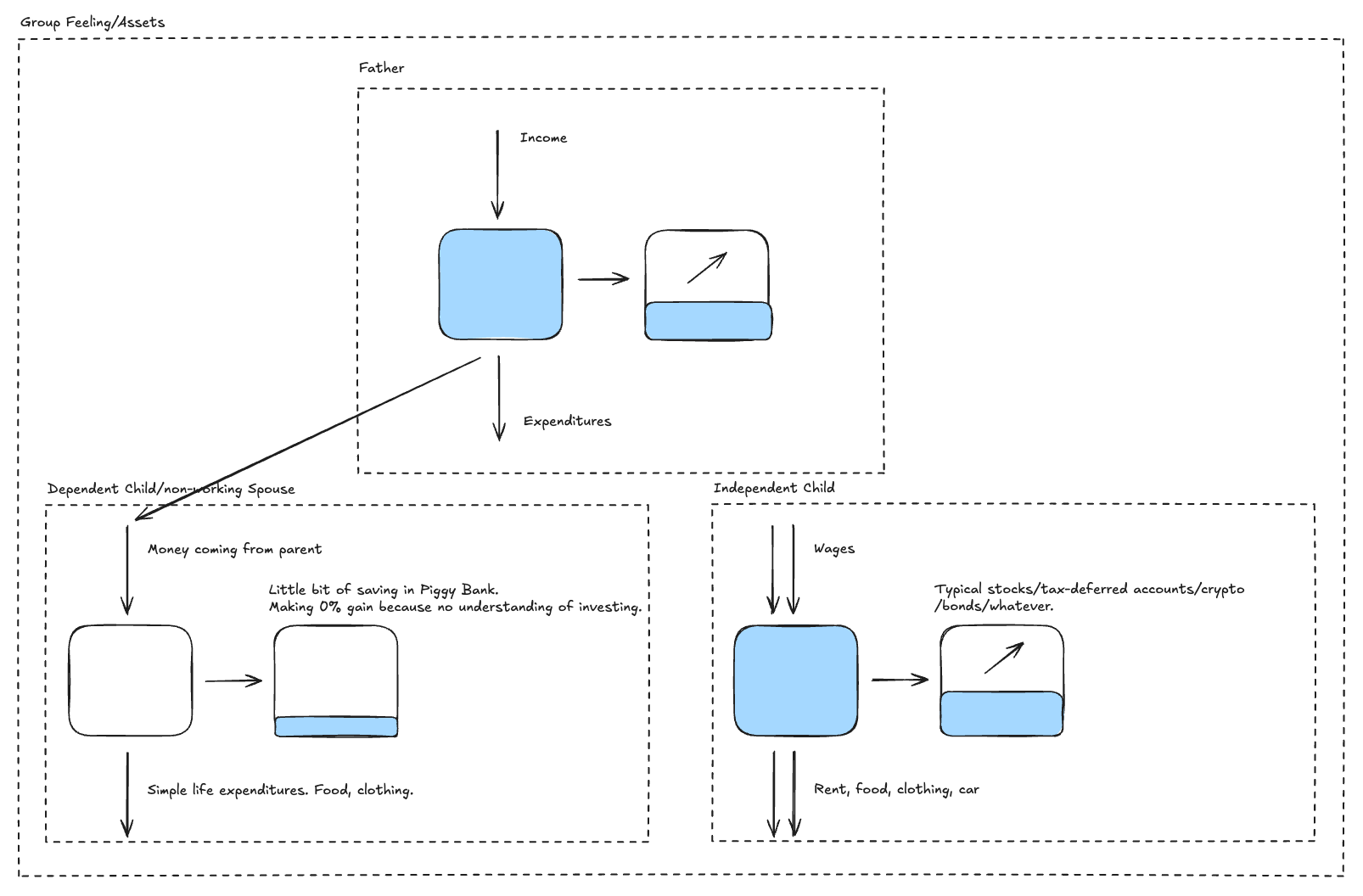

Here is a diagram of a family with an adult son, two parents with a single father working, and a dependent child.

We thus see that this is meant to scale: from a family, to a company, and then to a national level. The assets are shared and are meant for the public good.

It may not be possible to perfectly scale trust across many many people, because there are misunderstandings and different contexts. But you should try to have economics expand the circle of group feeling and trust to as many people as are capable of it. Group feeling can be enhanced by culture, background, language, values, etc.

Some groups are able to expand this circle of trust beyond their immediate circle, while others are more clan-like and insular. The economic free trade and borders/visa question must be answered by figuring out to what extent the peoples and demographic groups capable of trust exist.

Money-Triangle Whole Society Mental Visualization

I was trying to understand how the economic pyramid structure of society works. We know that words create an ‘idea-world’ which in cities are often interleaved with each other due to proximity, like multiple pyramids, and we know that generally the secondary worlds (businesses, culture) are a subset of the State.

Obviously, income has to come from somewhere. For businesses they get it from the customers, and then from customers/more customers.

Where is the spigot of money? How is the Cantillion effect working? Strong spigots can come from grants, loans, universities, federal spending, foundations, and large companies, but in general it seems that in a market economy with many small transactions, the source is the general mass of society rather than a complete vertical top-down money flow triangle arrangement. So after funding/inflating the economy with money, it kind of sustains itself to some degree.

So the money is meant to trickle down according to group feeing, but the labor share of income is decreasing. So those at the top don’t have group-feeling for those at the bottom, so they reinvest into robots and stock buybacks. Those at the bottom are in subsistence, so not enough income to save money to put into assets. And if they do, they gamble/do options/high risk. Expensive expenditures such as automobile and housing drain them, they see no future. As the USA deindustrialized, they shrank the economic circle to smaller and smaller amounts.

There is also some money loss per year. However, Claude says it is an insignificant amountm like 0.002%. I had originally thought it might’ve been like a continuously flowing tree: a top-down source of money continuing to go down, and those on the edges of society at the bottom dying/losing money.

Societally the bad job security is causing the economy to go to more short-term thinking, which hampers reproduction.

I am imaginging a sort of inflated/bubbly upper class in the USA, with little trickling down to the lower margins except subsistence for healthcare to keep these people alive in the fake world. I am trying to imagine what it would look like if the money was no longer fiat. I think the savers at the bottom would benefit a little, but at the top the money would still not be circulating to the bottom.

And I still haven’t quite visualized how the State (which is pulling in taxes from all savers) uses bonds/fiscal policy for government spending.

I was in the bathroom washing my hands and thought about how continuous inflation may not actually be a problem. Quigley thought because income is the expenditure of businesses, but consumers need wages to purchase goods, but they are guaranteed to save a proportion of wages, thus the system would have to continue to increase so consumers can buy that same goods that businesses create.

However, based on the above model if most people had some sort of stock market savings with the guarantee that it would go up, they would have enough resources to withdraw from while keeping out the most negligient in the way that UBI causes, because the equities would redistribute enough money to people through society-wide inflation.

Nevertheless a FT comment says ‘how will you sell wares to yourself’ if incomes are not rising? So there may still be a structural contradiction.

Moreover, I am trying to visualize why societal construction is so shitty nowadays. The most damage is not caused by people who are at the edges, because they don’t have enough power to build things. The most damage is caused by those in the middle who have enough ability to make shitty abstractions and terrible buildings and connections to sources of money, but are not good enough to build a good society. It seemed like construction and culture was previously the purview of a highly refined class, but whether that assumption is true I know not—there are plenty of examples of bad leaders throughout history. Whether someone good or bad ends up on top seems to be a matter of luck.